Why invest in property?

Investing in property is one of the most reliable ways to build long-term wealth. Whether it’s to increase your monthly income, grow your pension pot, or create a better life for your family - property remains a proven path to financial freedom.

At NGU Homes, we’re not just agents - we’re active investors ourselves. We own over 150 properties in the North East and have sourced more than 400 properties for our clients. We live and breathe property investment, and our mission is simple:

To help you make money from property while treating tenants fairly.

We provide a complete, hands-off solution - helping you purchase, refurbish, manage, and sell - all under one roof.

Our 10 Guiding Principles of Successful Property Investment

1. Start With Your Goals

Every successful investor begins with a clear goal. What does success mean for you?

- Secondary Income:

Beat the banks - property offers returns of 8%–30% vs. 3% in savings accounts. Use it to supplement income or fund your retirement. - Financial Freedom:

Replace your 9–5, build a portfolio, and create freedom for you and your family.

2. Define Your Investment Strategy

Before hunting for deals, decide what type of property you want:

- Low-value properties (£20K–£90K):

Ideal for first-time investors. Less capital growth but easier entry.

Strategy: Buy, refurbish, and let. - Mid-value (£90K–£150K):

Flexible for HMOs, flips, and long-term growth. - High-value (£150K+):

Higher capital growth potential - better for seasoned investors.

Ask yourself:

- What’s my budget?

- Who’s my target tenant?

- Is the strategy cash-flow positive?

- What’s my exit plan?

3. Choose Your Strategy Wisely

Here are 4 of our most popular, proven strategies:

| Strategy | Investment | Monthly Profit |

|---|---|---|

| HMO | £60K–£120K | £1,000–£1,500 |

| Buy, Refurb & Add Value | £40K–£70K | £350–£500 |

| Rock Solid Rentals | £15K–£40K | £350–£500 |

| Rent from Day One (Tenanted) | £10K–£25K | £350–£500 |

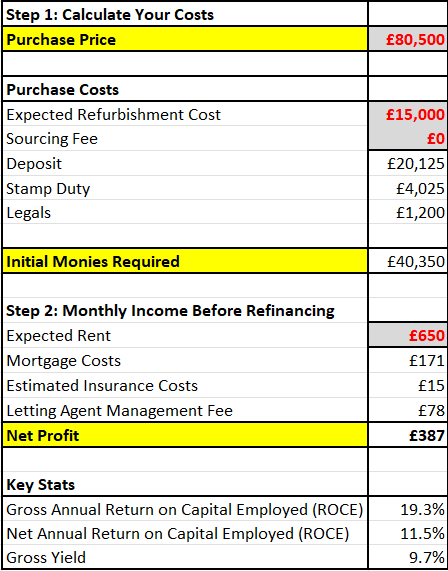

Accelerate With the ‘Buy, Refurb & Add Value’ Strategy

Example:

- Purchase Price: £90,000

- Deposit: £22,500

- Refurb: £20,000

- Post-Refurb Value: £135,000

- Rent: £800pcm

- Annual ROI: 27%

You can refinance to release capital for your next project - this is how you scale.

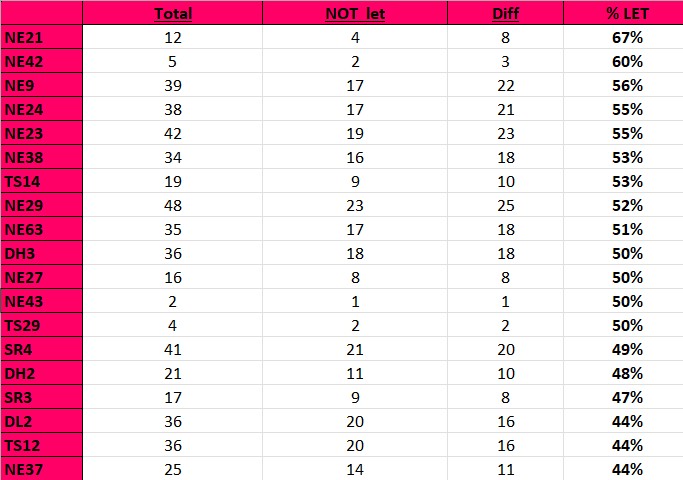

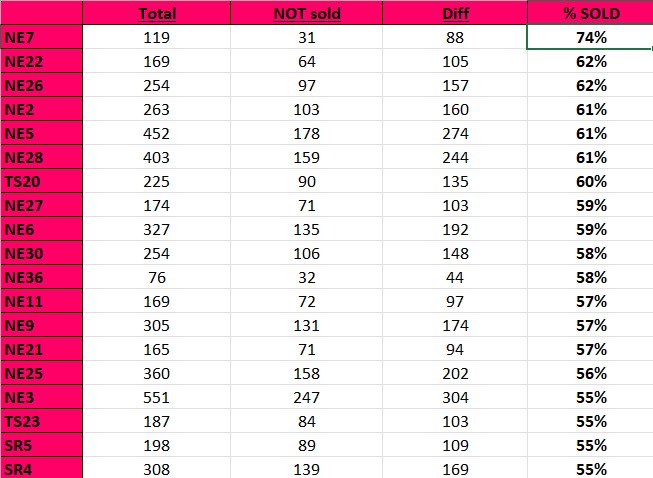

5. Invest in Prime Locations

We analyse local data monthly to identify high-demand postcodes across the North East. Location is key for growth, tenant demand, and long-term returns.

6. Remove Emotion - Invest with Numbers

We use our Deal Machine, to calculate whether each opportunity meets your financial goals. Data-driven investing always wins.

7. Understand ‘The Slip Point Principle’

What separates great investors from average ones? Small margins.

- Little Money Left In:

Accept leaving 10-25% in great areas with long-term growth. - No Money Left In: Often possible in cheap, poor-quality areas - but these come with risk: voids, bad tenants, and zero capital growth.

👉 We advise against “bad areas” despite the attractive yield. Good tenants don’t want to live there, and capital growth is limited.

8. Enjoy an Armchair Investment Experience

- Refurbs handled by our in-house NGU Property Refurbishments

- Management handled by award-winning NGU Homes

- Hands-off from day one - ideal for out-of-area or busy investors

9. Use Proven Systems

We’ve built step-by-step processes to maximise every investment:

- Project management tools for refurbishments:

https://nguhomes.co.uk/refurbishment-services - Award-winning tenant management with NGU Homes:

https://nguhomes.co.uk/landlords - Exit strategies with NGU:

https://nguhomes.co.uk/selling-property

10. Learn from Experience

Our team shares their success stories and insights - because we've done it all ourselves.

- Read our YPN Investor Feature

- Meet Abi Patterson-Wright, part of our investment team, for a 1-to-1 strategy call.

Book a Free Investment Consultation

Whether you're new to property or ready to scale, your journey starts with a free, no-obligation consultation.

📞 Call us today or

📩 Fill out our contact form and we’ll call you back.

Let’s make property work for you.

Get a Free Valuation

If you're contemplating becoming a landlord, the best starting point is to get an idea of the market value of your property.

Book ValuationUse our Rental Yield Calculator

Use our handy calculator to work out the potential rental income and total yield foryour property.

CalculatorGet in Touch

If you would like to discuss your property-related enquiries, or have any questions, get in touch with our friendly team.

Get in Touch