When buying property do you go for high yield or high capital growth? In my opinion you very rarely get both. When I first got...

When buying property do you go for high yield or high capital growth? In my opinion you very rarely get both.

When I first got into property everything I bought was high yield since I didn’t have the money to buy anything else. I’d typically buy 2 bed flats in Bensham, Gateshead which yielded 9-10%.

I’ve still got a few to this day, 10 years later, which give me a good rental income but I’ve seen very little capital growth. Also higher yielding areas tend to be “tougher” where management can be difficult with more issues, voids longer and the risk of damage higher. Better areas tend to outperform on a capital basis due to stronger home owner demand.

Below is a video from my brother Chris, showing you a typical high yielding property we manage for an investor. They’ve bought it from auction, we’ve refurbished it and will be managing afterwards. I’ll also share with you some key stats we use to demonstrate whether it’s best to go for yield over house price growth.

Click on video 👇

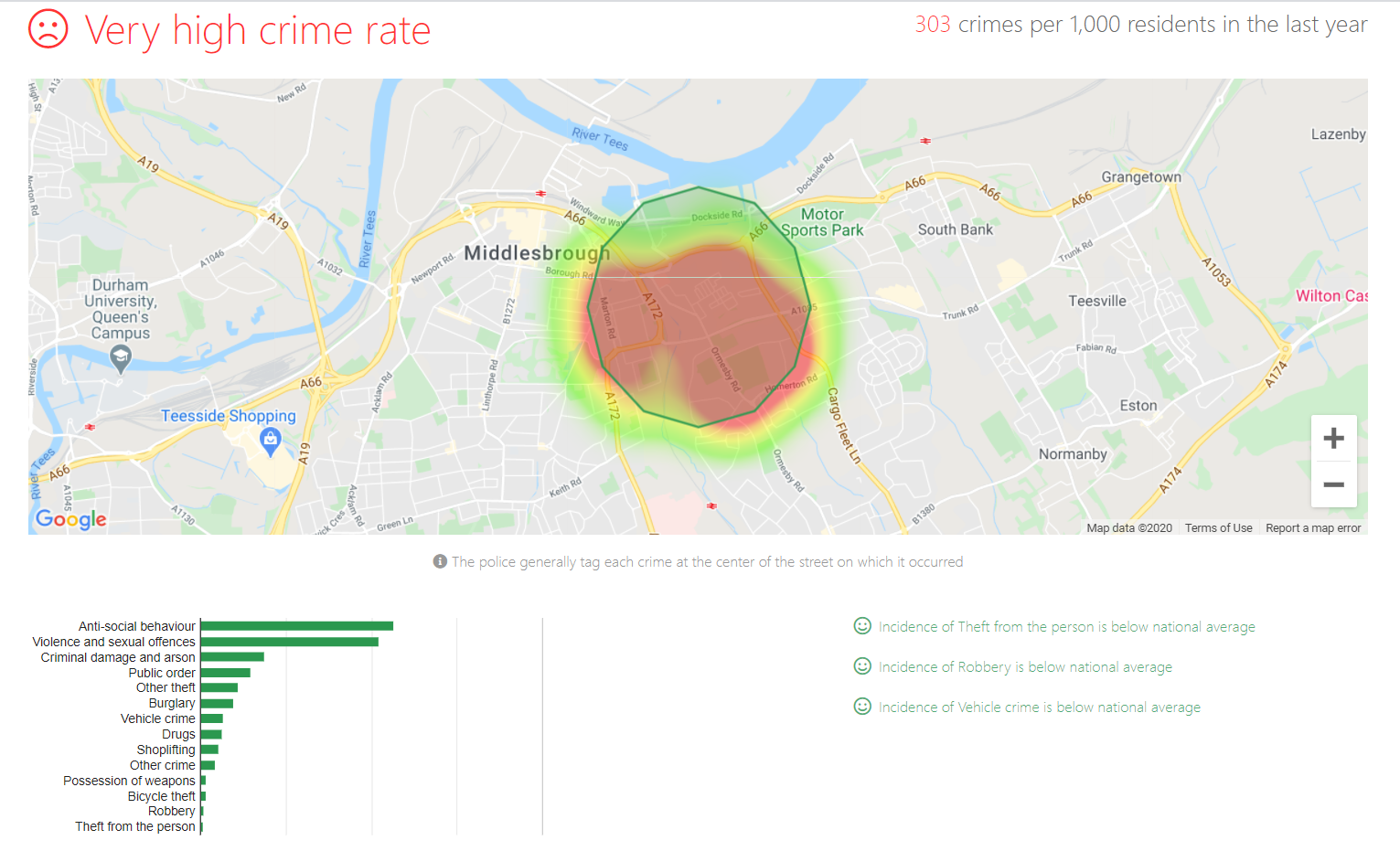

As mentioned this property is in North Ormesby, a “tough” area which is high yield and typically wouldn’t have high house price growth.

Average Yields are 8.1% for 2 Beds & 5.3% for 3 Beds – pretty strong 💪

But what about house price growth 🤔

As you can see below average prices were up 5% on a 1 Year and 10% on a 5 Year basis vs 6% & 20% for the UK. Typically you’ll see this from most areas with fewer homeowners, which generally underperform the overall market.

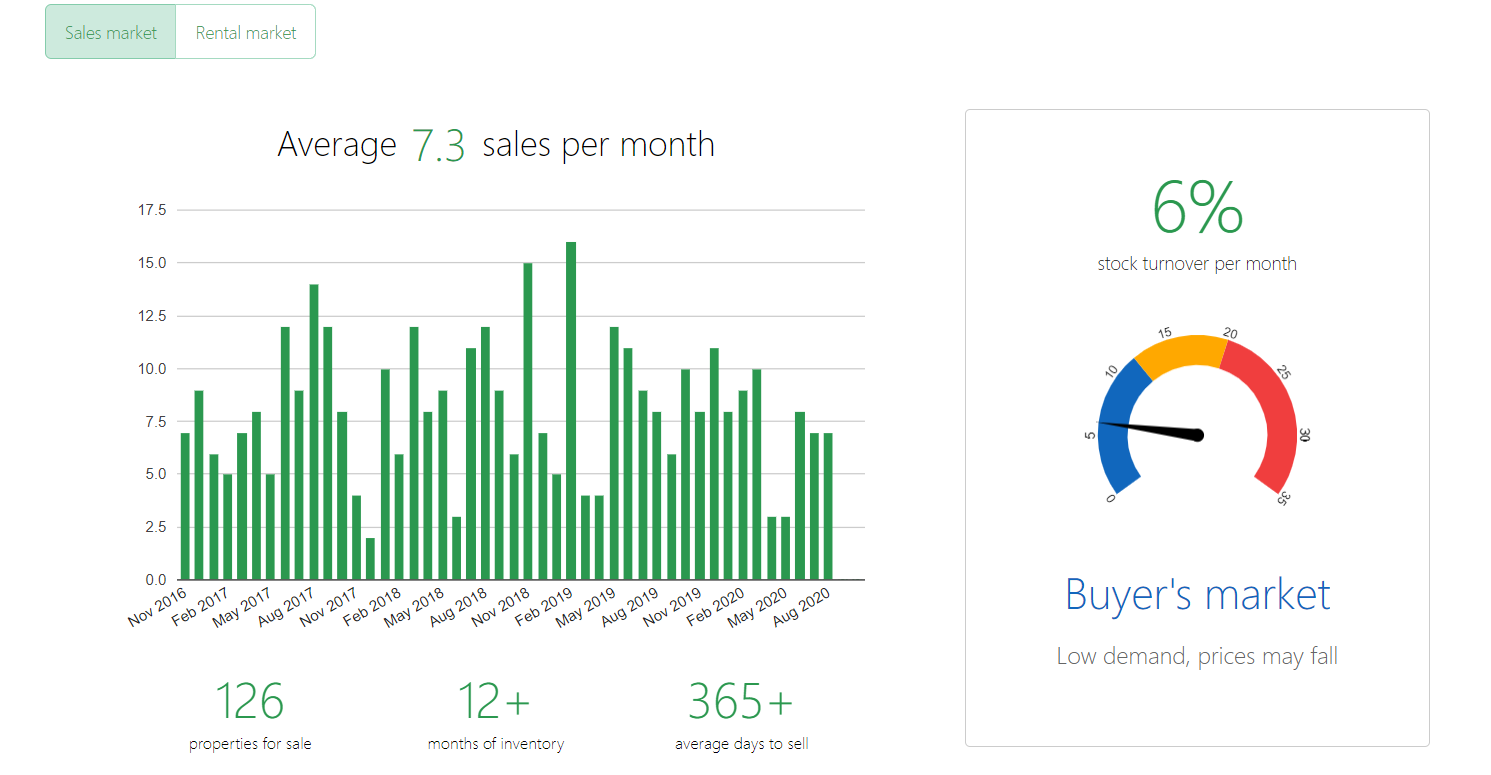

Another key ratio we use is stock turnover (number of properties sold vs number available). Again you can see this area is a buyers market.

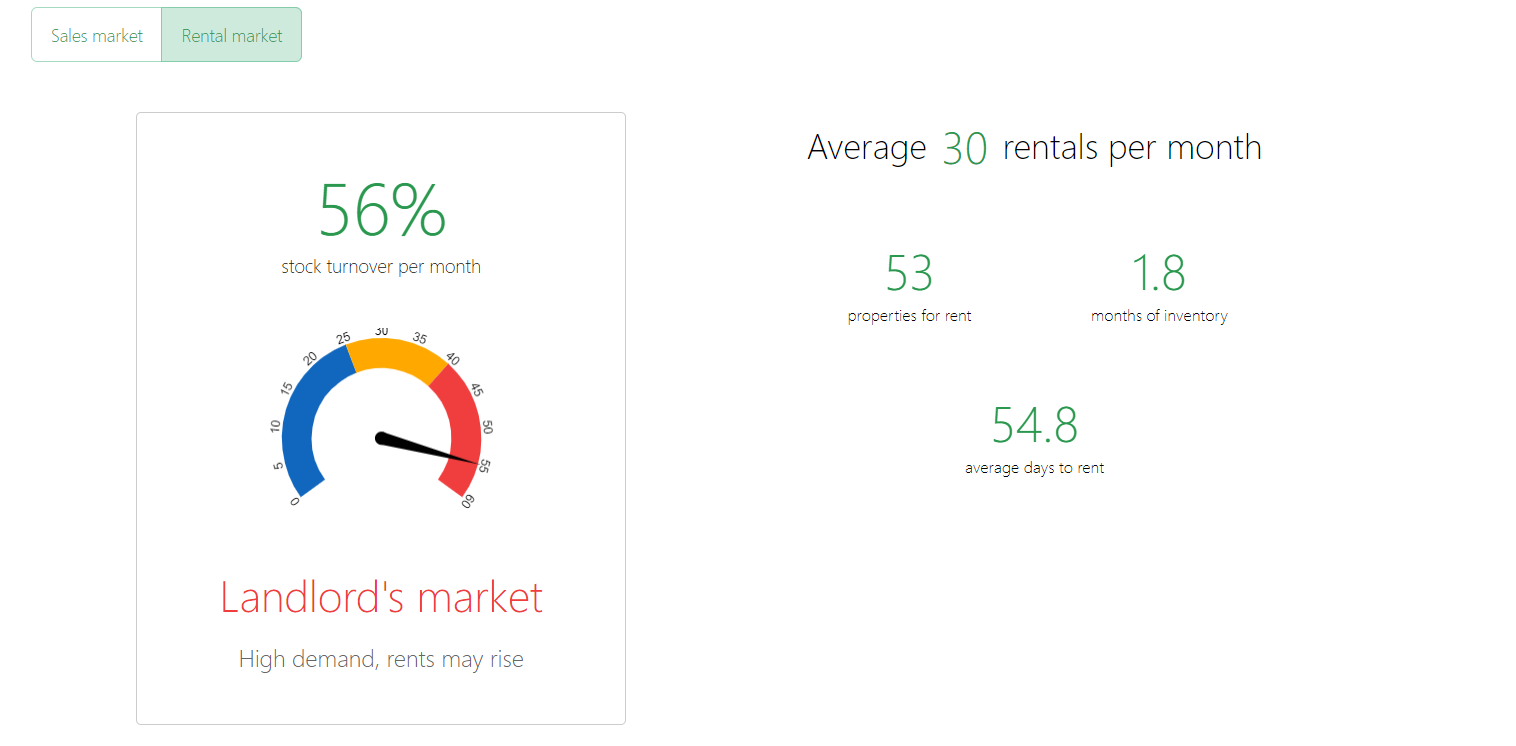

We also look at rental demand, rentals per month vs properties available, as you can see demand is quite good but we’re finding this in most areas.

Finally just to confirm how tough an area North Ormesby is we’ll generally have a look at some demographics as you can see below the areas crime is quite high.

You often don’t get high yield and high capital growth but what are you looking for?

We tend to source in the middle – medium yield in not the best but not the worst area.

Why?

Our aim is generate long term capital growth for our landlords and we think that double bubble from both, gives you the best of both worlds.

If you’re interested in getting started on your property journey let us know and we can tailor your investment needs by finding a property which meets your criteria using some of the above tools we have available.

posted by

posted by

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link