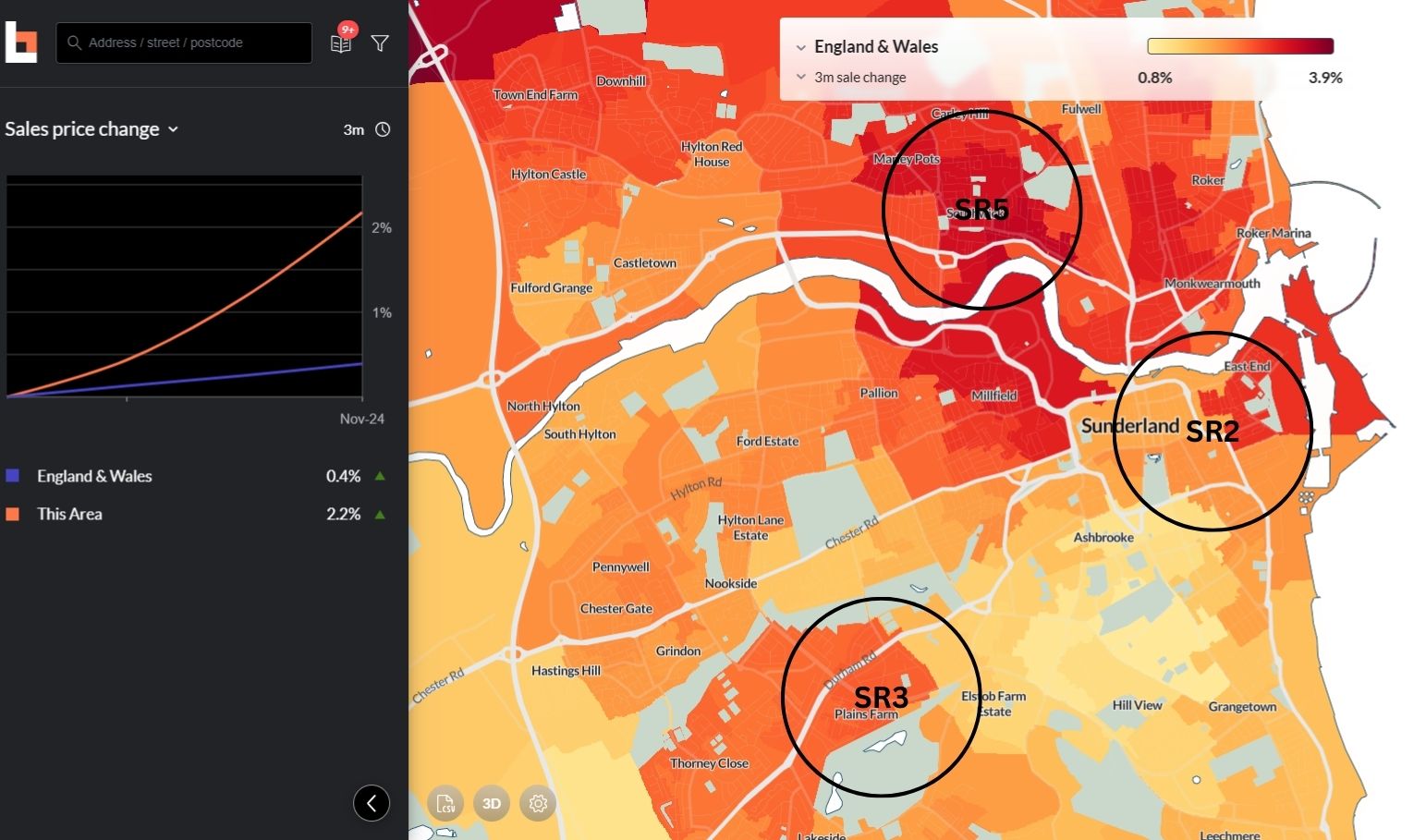

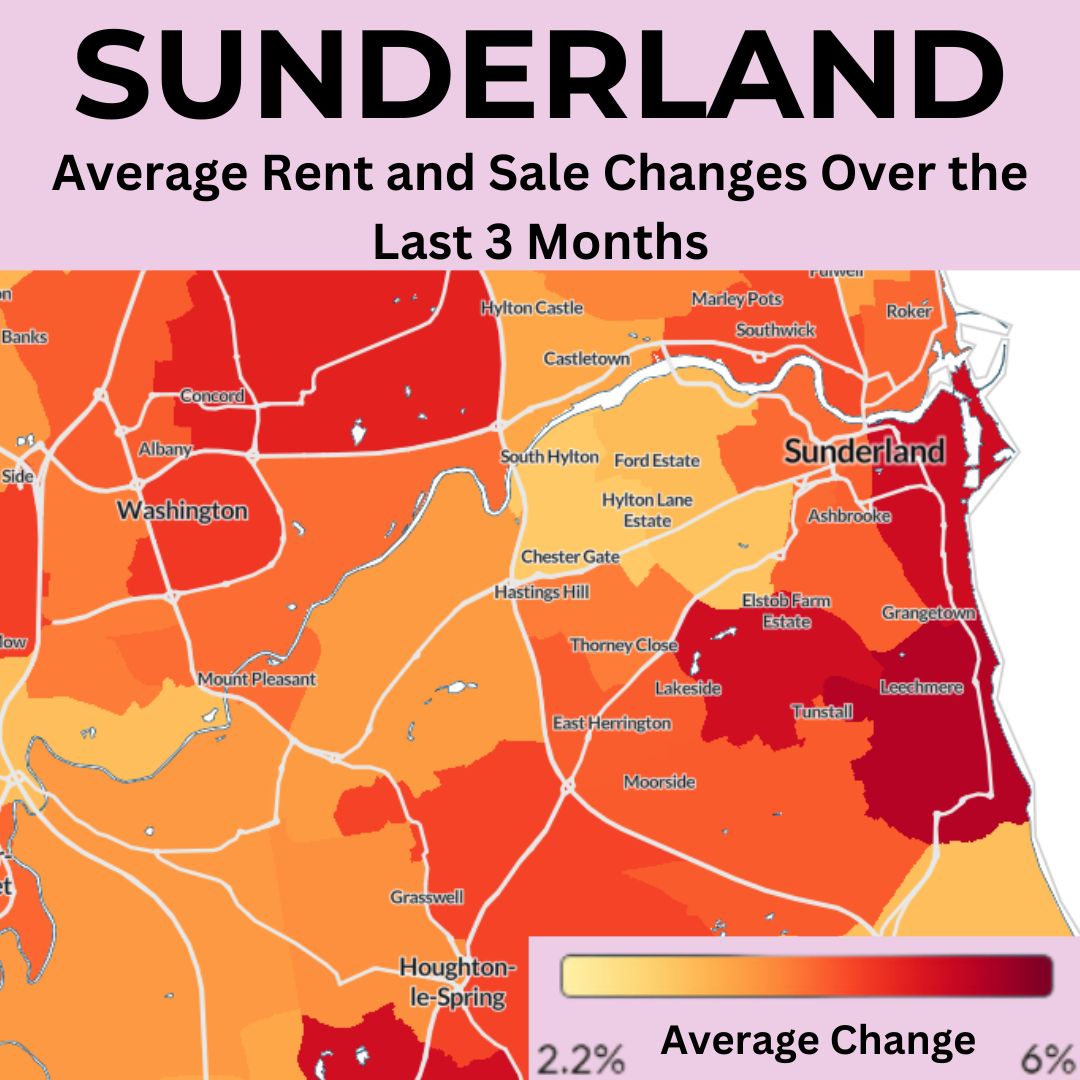

Regarding property sales, Sunderland is smashing it right now, doing way better than the national average. Over the last three months, prices have jumped 2.2%, compared to just 0.4% nationally.

SR3 is on fire! This area’s sales prices are up 2.2% too, and sellers are making the most of this buzzing market.

Here’s a real example: we just sold a 1-bed flat for £50,000, which brings in £450pcm in rent - a solid 11% yield. Deals like this are out there if you’re ready to dive in.

If you’re not looking at Sunderland for your next investment, you’re missing out.

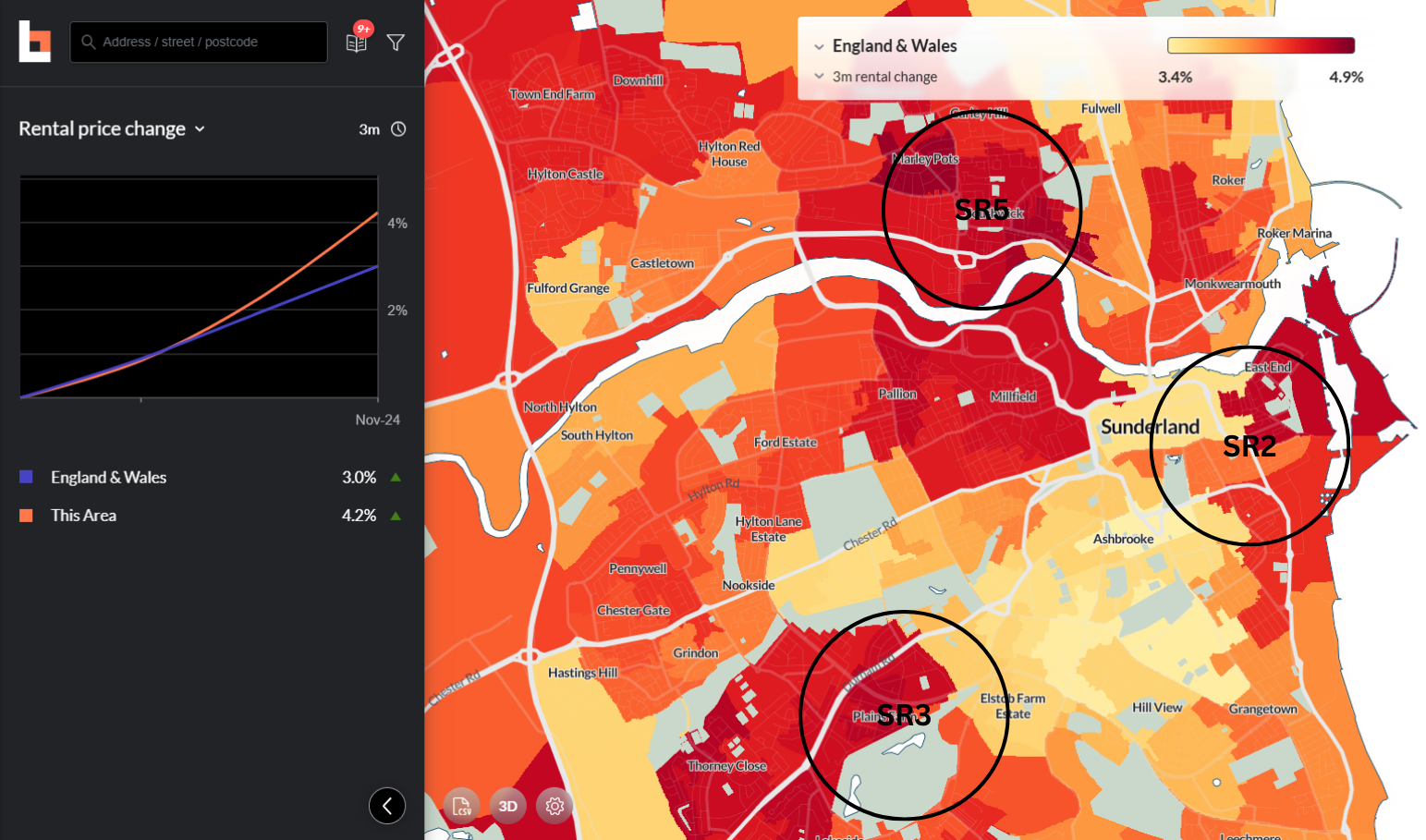

The biggest driver of growth in Sunderland, though, is the rental market. It's up 4.2% over the last 3 months vs. 3% nationally.

Sunderland: A Red-Hot Investment Opportunity! 🔥

Eastbourne Square, SR5: This 3-bedroom house was rented at £610pcm in 2022. Fast forward to 2024, and it's achieving £675pcm—a clear sign of growing demand.

Runnymede Road, SR5: A 2-bedroom house that rented for £550pcm in 2022 now commands £695pcm in 2024, reflecting outstanding rental growth.

Fuller Road, SR2: A 2-bedroom house that rented for £500pcm in 2020 now commands £565pcm in 2024, reflecting a steady rental growth.

Shaftoe Road, SR3: A 1-bedroom flat that rented for £395pcm in 2020 now has the potential to achieve £525pcm in 2024, showing increased rental growth.

Why Invest in Sunderland?

With property values starting from around £80k for 2–3 bedroom properties, Sunderland offers an exceptional investment opportunity. Yields are as high as 10% combined with strong rental demand make this area a hotspot for investors aiming for reliable returns and long-term growth.

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link