GAIN KNOWLEDGE – FIND OPPORTUNITY – TAKE ACTION Award Winning Letting And Estate Agents 2017 Telegram App – Click The Link To Download Telegram...

| GAIN KNOWLEDGE – FIND OPPORTUNITY – TAKE ACTION Award Winning Letting And Estate Agents 2017 |

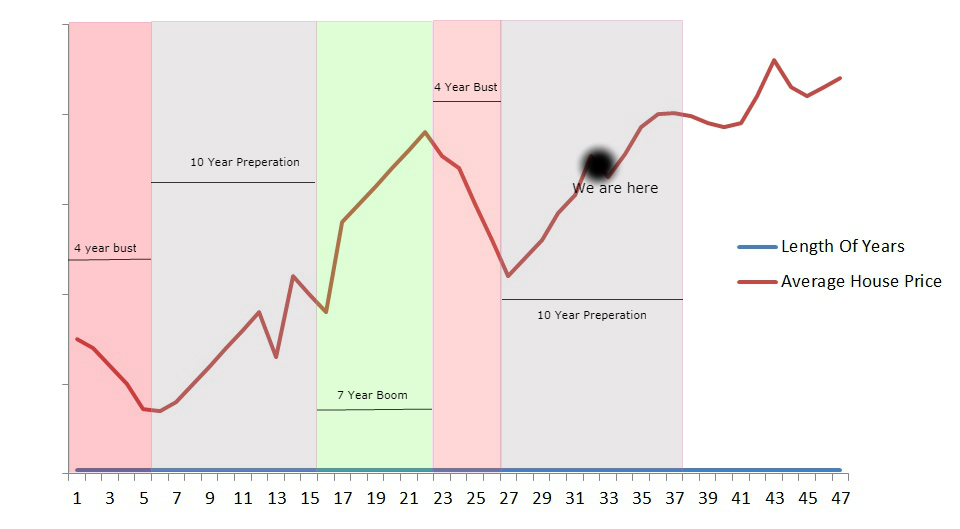

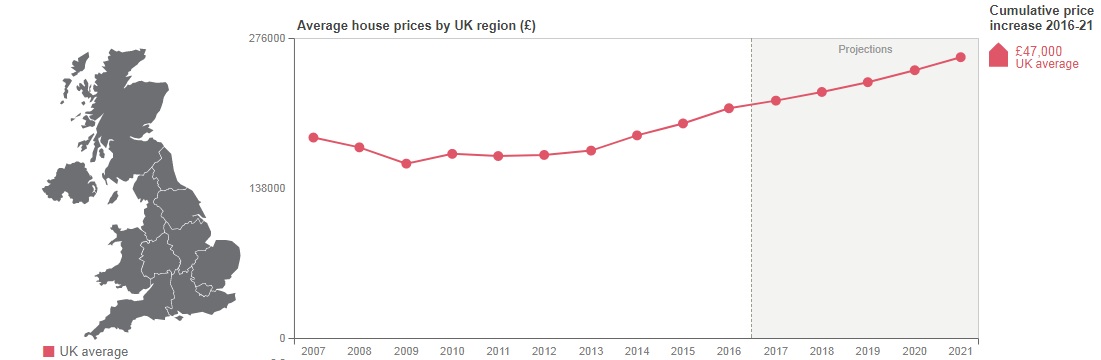

Telegram App – Click The Link To Download Click Here – Join Our Free Channel DOWNLOAD THE FREE APP ON SMARTPHONE OR VISIT VIA YOUR PC. Buy properties in good areas – Analyse this deal by looking at the postcode activity in 2017. | THE PROPERTY CYCLE – PROFIT BY PREPARATIONFor many people wealth is tied up in property after experiencing a cycle of extraordinary house price growth. Some years experienced double digit growth and there were other periods when the market was flat on its back or falling. The property cycle goes through a few phases. Each system is interlinked with the banking, mortgage and business cycles! Over the past 22 years we have seen a a lot of global and national events that have moved the housing market. From interest rate cuts, investors liquidating holdings, change in legislation but mainly the correlation between property investment and economical indicators that largely depends on key factors like GDP, unemployment, and income growth. Please see an illustration of the trend and the forecast of the short term future. Some events that are obvious are the housing crash in the late 1980s, the boom and bust at the turn of the millennium and the change in the Bank of England interest rates. (Read More Here) What are the signals? Where are we now? With confidence making a comeback, property investors are showing EXTREME responsiveness to record low interest rates.The Bank of England voted to keep the Bank Rate at a record low of 0.25 percent on August 3rd, 2017 Gross yield are up! Especially with a number of attractive fixed rate finance options available, meaning investors are responding much quicker to these conditions than owner occupiers. Over the past 2 years more and more accidental landlords are taking the upturn as a chance to sell existing stock pointing to a further recovery in the housing market. There is still time! |

|

|

| “Your Property – My Passion ” Book A Free Consultation |

Mike Bell – Head Of InvestmentsNGU PROPERTY INVESTMENTS | |

posted by

posted by

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link